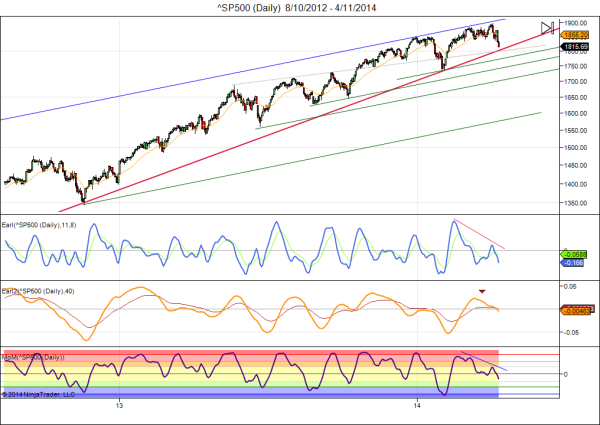

US stock markets have started to slide. It’s not that we have not been warning in recent weeks, as all my indicators have been pointing down. I could actually repost my March 24 outlook and be done for this week. But that would not be interesting and I have some new charts and information, so let’s start by taking our weekly look at the S&P 500 (click for larger image):

Bearish divergences are now even more clearly visible in all my indicators. The 1800 level is very important for the S&P. If that level doesn’t hold then a drop to the 1600-1700 area can come really quick. So we better be careful. Yes, a crash is possible when such a long term trend line gives way. As we have pointed out before, eclipse red periods have a history of producing sharp downturns and this time is no exception. We remain in lunar red period until the end of this week and I expect some bottom to form soon. The ensuing eclipse green period usually brings a strong rebound, so be ready to do some speculative buying on down days. If the S&P holds the 1800 level this week then it can even surge back to 1900 by May. We will study that scenario next week, before the green period gets underway.

I notice on social networks that some investors are thinking that a stock market crash will cause gold and gold stocks to surge higher. So, should you buy gold in anticipation of a possible crash? Well, based on history the answer is: no. Just looking at some of the most famous recent crashes:

* October 1987 crash, gold price: $455 -> 3 months later: $480, 6 months later: $445, 1 year later: $396.

* Mar-May 2000 (Tech crash), gold price: $293 -> 3 months later: $272, 6 months later: $277, 1 year later: $266.

* Aug-Nov 2008 (Nasdaq drops 50%), gold price: $912 -> 3 month later: $730, 6 months later: $918, 1 year later: $960.

Buying gold as protection for a stock market crash doesn’t look like a good idea. The reason is not hard to guess: a stock market crash has deflationary effects and causes some investors to liquidate other assets (like gold) to avoid bankruptcy or margin calls. The better strategy is to buy gold 3 months to 1 year after the start of a stock market crash.

***

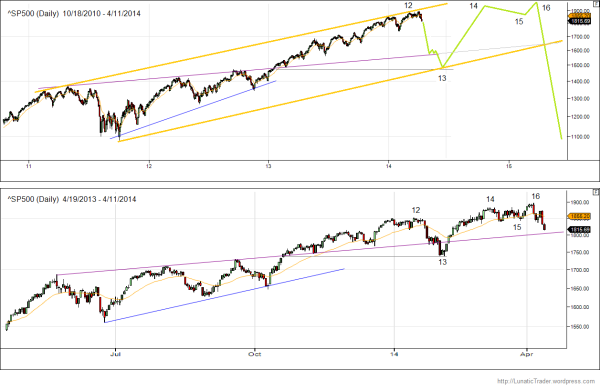

As a little extra this week I have a few other charts to share. There is an interesting market fractal appearing in the S&P 500 index. The S&P market action since late 2010 looks exactly like the movements between April 2013-January 2014, as you can see in this comparison chart (click for larger image):

I have numbered the major turning points. In both cases we see a rising wedge pattern(1-6) followed by breakout to the upside(7) and a revisit of the resistance line that has turned into support(8). Then a further rise and congestion period(9) leading to a flat topping pattern(10-12). This is as good a market fractal as you will ever see. And we already know how the pattern has continued in the ensuing months. If the fractal continues to hold up then we can look forward to this scenario (click for larger image):

From the topping area(12) we got a quick drop that found initial support on the old trend line and then dipped even lower to bottom out at the level where it broke away from the old rising wedge(13). And then a surge to new all time highs with another broad topping formation (14-16).

Will this pattern repeat? I don’t know. Bear in mind that this kind of market fractals cannot work forever, so it is more a question when and where will the market break away from this pattern and especially: how? But as long as it is in play it is a scenario worth watching. Right now it suggests a summer 2014 low around 1500 and a final market top in 2015 with the S&P 500 climbing above 2000…. and then a real crash. Well, why not?

Good luck,

Danny

excellent work………. gold will fall also. ………….well done.

Danny, you are always quite articulate. And yet this was one of your best posts! Awesome content and endearing writing style. Thank you for sharing, as always. :-)

Thanks for the thumbs up, KR