A lot of traders scoff at the idea of lunar cycles in the stock market. But I like that, because if too many people start using a given edge in the market it usually leads to its disappearance. When something gets used up to full “capacity” then it fades away. So, as long as enough traders discard lunar cycles as “astrology” without taking a closer look, so long it probably helps to keep our little lunar edge alive. So far this year, the Nasdaq has gained 533 points in our lunar green periods and it has lost 5 points in the lunar red periods. Not bad. More on this below, let’s first take a look at the S&P 500 (click image to enlarge):

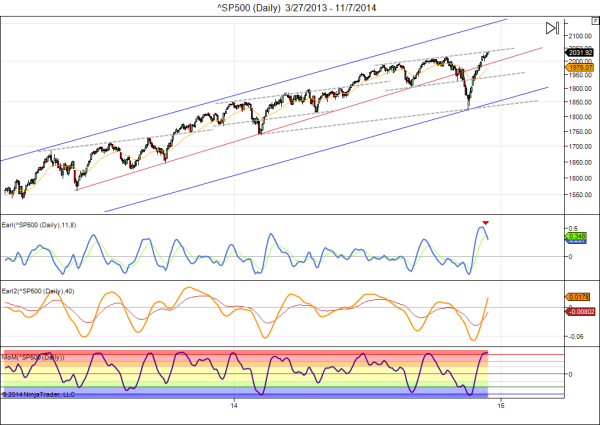

The S&P has continued to grind up and is now bumping into overhead resistance near 2030. We are starting a new lunar green period, which normally favors further gains. But in this case it doesn’t really look like a favorable setup for going long, because all my indicators are into overbought territory. The Earl has already turned down, and the MoM resides in overoptimistic +8 spheres. The slower Earl2 is still climbing nicely, which keeps the door open for new highs.

Overall, it is a situation where I think the next few weeks are going to be sideways at best, with good odds that we will see a retest of the 2000 level and possibly even 1950. There is no reason to become overly bearish at this point, but the market probably needs to catch some breath.

***

The day to day movements of stock markets are commonly attributed to changes of mood in investors. But that begs the question: where do these mood changes come from? Is it merely a result of getting good or bad “news” about the economy, or is there more to it?

Quite a bit of research has been done in this field. Here are some topics that may interest traders:

1) Sunshine. Do you feel more upbeat on a bright sunny day? So do many other people/traders. There is a correlation between sunshine and stock market returns: Good Day Sunshine:Stock Returns and the Weather

2) Seasons. Do you suffer from seasonal affective disorder (SAD)? In some countries 10% or more of the population does. There is a correlation between the seasonal variation of the length of the day and stock returns, also known as the seasonal tendencies: Winter Blues and Time Variation in the Price of Risk

3) Geomagnetic storms. Geomagnetic disturbances seem to affect a portion of the population. Stock market returns are lower in the six days after a geomagnetic storm. See this Atlanta Fed working paper: Playing the Field: Geomagnetic Storms and the Stock Market

In all those cases a hormone called melatonin is involved. If we have lowered melatonin levels we feel depressed, and then we probably trade accordingly. This brings me to:

4) Lunar phases. Swiss researchers found new evidence suggesting that a portion of the population doesn’t sleep so well in the days around full moons. It also knocked down their melatonin levels. Bad Sleep: Blame the Moon That would be a good explanation for the weaker stock market returns in our lunar red periods, which end 3.5 days after full moon.

5) Days of the week. Stock returns are historically weaker on Mondays. Why? Are melatonin levels also down because some people had shorter nights over the weekend? Or because some do not really look forward to another week of labor. The Day of the Week Effect

Our mood is clearly a complex animal, with many artificial and natural factors coming together to influence our emotional state. Some natural factors are affecting the entire world population at the same time, and appear to be partially responsible for the day to day moves in financial markets.

Good luck,

Danny

Moon effects the tide everyday, and I would like to know whether this tide effects can be applied on stock market or not.

Do you have any suggestions?

Thank you very much for any suggestions :>

Yes, some people try to use tides for stock market, and I may add tides in the LunaticTrader software. But the problem is that tides are local, differing from place to place. When it is full moon, it is full moon everywhere on the planet. But West coast of the US can have high tide while at the same time it is nearly low tide on the East coast. We can use the tides in a location near New York for the New York stock exchange, but why would a trader in California or in Europe, who are also participating on the New York stock exchange, be affected by the tides in a location that differs from their own? There is something counter-intuitive about using tides, because we know that markets around the world largely move in tandem most of the time, even though the tides vary in all these places.

It would be great if tides were useful for trading, especially day-trading. But I have not found any logical way to use tides in the market.

You are not the first ask this. It is a good question. Unfortunately there is no straightforward approach to use tides in the market.

Danny

Referring to following statement, I would like to know on why Storms seemed to occur preferentially near first and third quarters.

Do you have any suggestions?

Thank you very much for any suggestions :>

“Geomagnetic activity was 12% lower than average at new moon and 7% lower at full moon. During the first quarter the activity appeared to be 7% higher than normal.”

Hi Eric,

And where is that statement supposed to come from?

Danny

Does anyone have any suggestions?

Thanks in advance for any suggestions

Click to access 19650014511.pdf