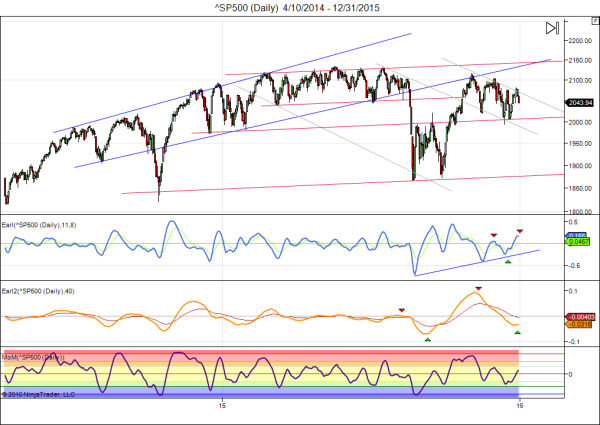

Stocks had a weak santa rally and the S&P 500 ended the yearly nearly unchanged. The S&P remains confined to the 2000-2100 range and the next major event is going to be when stocks break away from that range, up or down. Let’s have a look at the chart (click image to enlarge it):

The bad news is that a pattern of lower highs and lower lows is starting to appear, and that’s bearish. The good news is that the slower Earl2 (orange line) has finally turned up, suggesting that the recent correction is nearing an end. But the faster Earl (blue line) is just turning down, pointing to short term weakness first. The MoM indicator is rather neutral. Meanwhile we are in a lunar green period, normally favoring rising stock prices, but the LT wave for January indicates an unusually weak green period. So, this is a very mixed bag and not a straightforward setup to buy.

Whenever we have so many noses pointing in different directions it is usually the shorter term indications that pan out first. In this case that would mean stocks stay weak until the Earl bottoms out again and gets in a position to go up together with the Earl2. And it could take a few weeks to get there.

Besides stocks I would also keep an eye on bonds in the first months of 2016, and this is our chart of the week (click image to enlarge it):

As this Bloomberg article points out, the world’s main economies have to refinance $7 trillion worth of bonds in 2016. With interest rates projected to go up from their historically low levels, investor’s appetite for those bonds may not be what it used to be. And that could get interesting, especially in the countries where bond redemptions will go up compared to 2015 (US, UK and China).

As you can see in the chart, US long term bonds (TLT) have been stuck within a huge triangle from which a breakout can be expected soon. If TLT drops below 119, then a slide towards 105 becomes likely and that would be a 10% loss for bond investors. From a foreign investor’s perspective it would take a 10% climb in the US dollar to offset that loss. Of course, if the US dollar keeps climbing it would also make US stocks more attractive for foreign investors, provided they don’t enter a bear market. That’s why I am watching bonds for the potential ripple effects it will have on US$ and on stocks. If bonds decline while the dollar goes up then US stocks could become the winner because of foreign inflows.

I think you are quite incorrect.

Bonds decline meaning Rates GO UP depressing the economy even more. That’s deflationary. Stocks won’t do well. The only asset class that will do well is – CASH.

All this talk about ‘Money sitting on the sidelines’, or ‘Money moving out of bonds into stocks’ is pure baloney. The only place that money will go is the place where it came from – VACUUM. We call it ‘LOSSES’. So, when ‘financial experts’ say that stock market lost $7 Trillion in wealth, they only thing you should conclude is that they are clueless. What most do not understand is – THAT MONEY NEVER EXISTED IN THE FIRST PLACE.

For Foreign Investors, if bonds decline, the US rates go up, so will the dollar. That means foreign governments need to refinance the debt in dollar at HIGHER RATES. Their economies and currencies take a hit. The foreign investors will not have enough money to INVEST in the first place. And if they are already invested in US bonds or real estate, say bye bye to them.

The Fed pretty much invited the rest of the world to short the dollar (borrow in dollar). I expect a few major corporations in the world as well as a few countries go down over the next few years as with the margin call on the dollar denominated debt comes due. That would mean borrowers selling their currencies and any assets to pay off the dollar-denominated debt. That will lower asset prices across the board, increase the demand for Cash and hence the rate lenders willing to lend at.

I like your blog and do check it regularly. But on this point, you are (and will be proven) absolutely incorrect.

The idea of “money on the sidelines” has always been a misconception. If people buy (or sell) their stocks in the market the amount of money on the sidelines doesn’t change because for every buyer there is always a seller. Person A sells his shares to person B, the net amount of money on the sideline stays the same because person A has the cash that person B paid for his shares. The shares and the cash have changed owner, that’s all.

Money is just a “unit of accounting”, it has no intrinsic value. Just like we use meters or inches to express a given length in the form of a number, we use dollar or yens to express economic value in the form of a number. And those numbers keep changing as value keeps being created and destroyed.

Hi Danny,

Happy New Year!

I am fascinated with your work and especially love the LT Wave Count. I don’t think I fully understand it because this month’s chart really confuses me. If I look at the candlesticks, it looks like there is a big move down from the 7th to the 14th, but if I look at the gray chart, the blue line is going up from the 6th to the 12th, which is the opposite. What am I misunderstanding? I really love this and want to understand it better. Thanks so much for all that you do!

Take Care, Francine

Hi Francine,

The candle stick is added to show what happened versus what the LT wave indicated. Obviously we cannot expect it to be perfect on a day to day basis. When the cycles “click” the LT wave usually does a good job of indicating the highs and the lows of the month. But there are also months when it doesn’t work so well.

In December the market failed to go up 6-12th, even though the LT wave was slightly positive for that week. The only thing it got right was a major low near the 20th followed by a rebound in the final week. That’s better than nothing.

Danny

Thank you, Danny.

Happy New Year.